what is suta tax california

Experienced sky-high unemployment rates. See Determining Unemployment Tax Coverage.

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

A new employers rate usually will remain the same for at least the first two or three years.

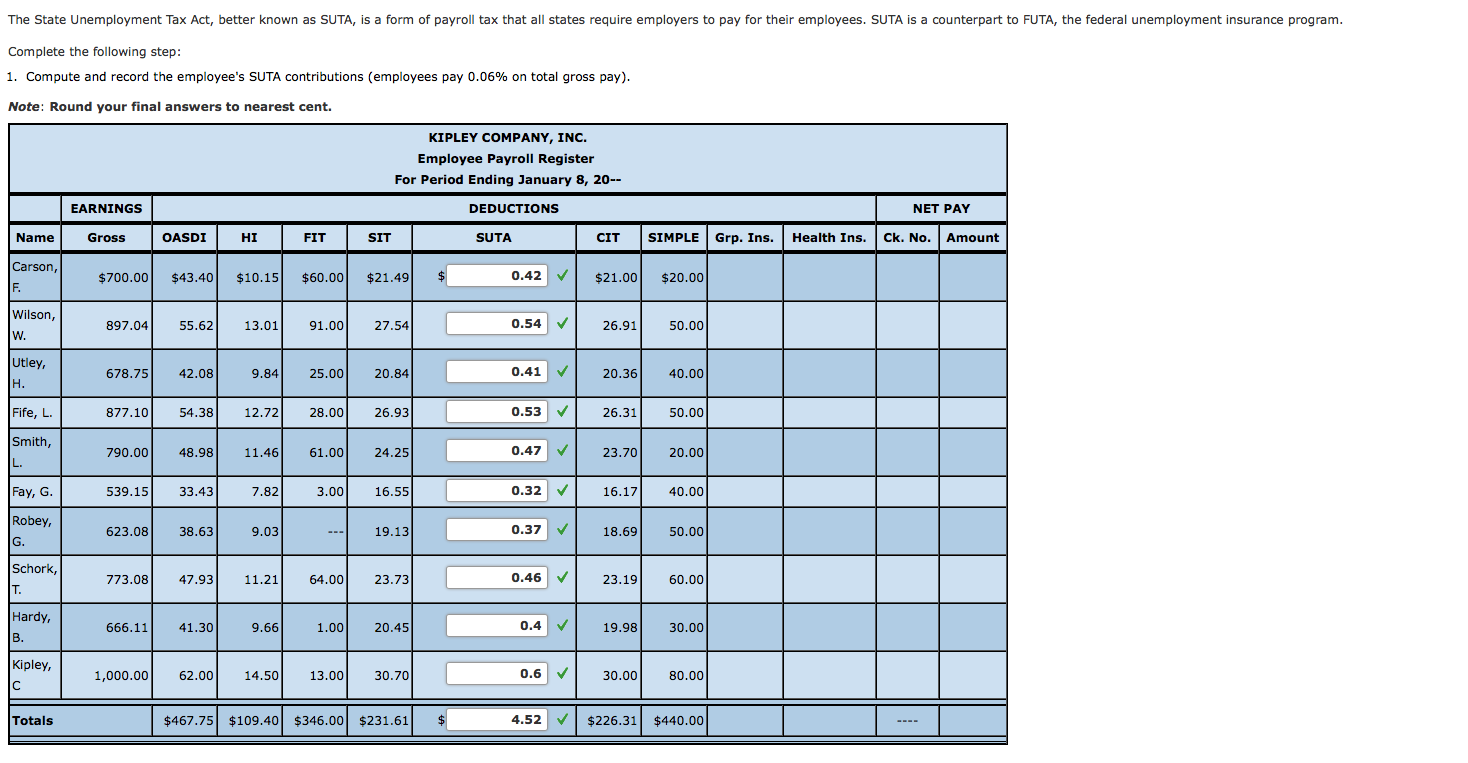

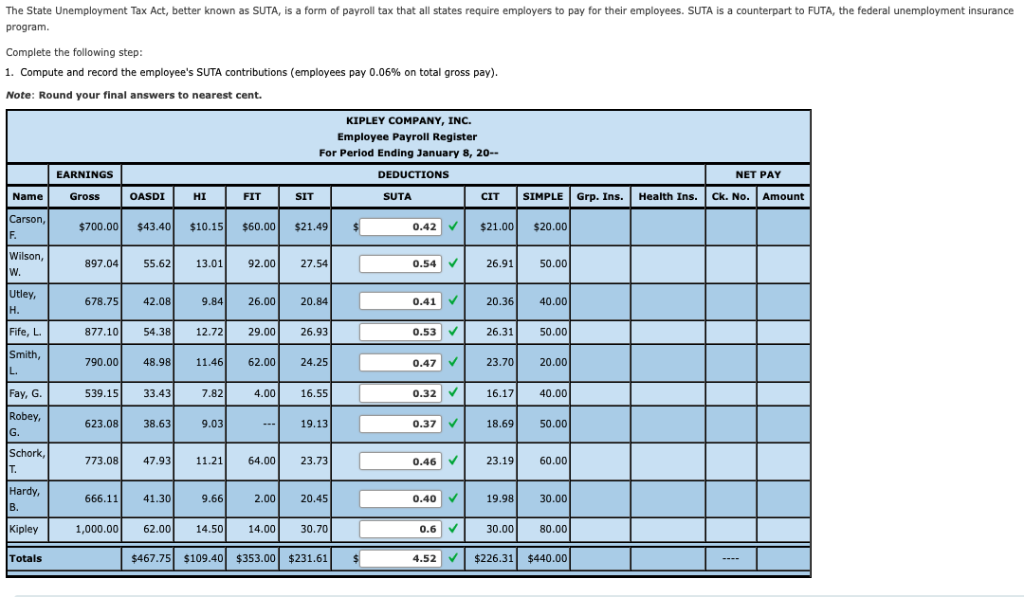

. Sutasui 7 state unemployment insurance 340 9 1 st 7000 10 ett employment training tax 010 1st 7000 11 11 700 maximum tax. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. California has four state payroll taxes.

State Disability Insurance SDI and Personal Income Tax PIT are withheld from employees wages. Transmittal of Wage and Tax Statements Form W-3 1. 9000 taxable wage base x 27 tax.

The new employer SUI tax rate remains at 34 for 2021. As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021 SUI tax rates continue to include a 15 surcharge. The SDI withholding rate is the same for all employees and is calculated annually.

The maximum tax is 434 per employee per year calculated at the highest UI tax rate of 62 percent x 7000 Government and certain nonprofit employers can choose the reimbursable method of. In California in recent years it has been somewhere around 34. Employers in California are subject to a SUTA rate between 15 and 62.

So for these businesses the rate would be as low as6. This means that employers paying wages subject to UI will owe a greater amount of FUTA tax. FICA tax is a 62 Social.

The SUTA program was developed in each state in 1939 during the Great Depression when the US. Generally unemployment taxes are employer-only taxes meaning you do not withhold the tax from employee wages. Unemployment Insurance UI and Employment Training Tax ETT are employer contributions.

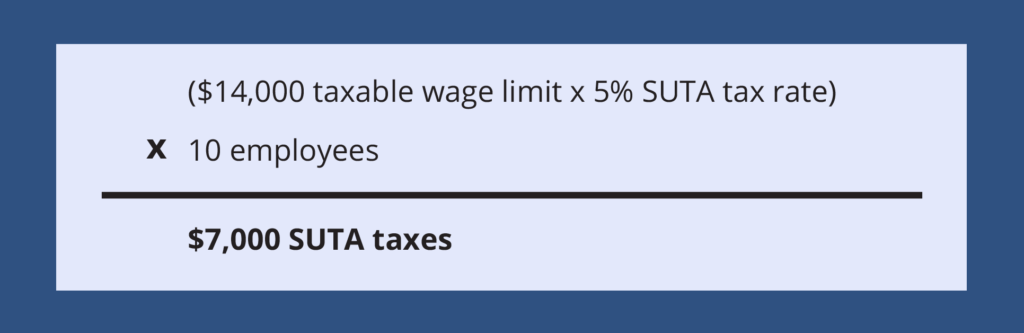

The maximum to withhold for each employee is 160160. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. This tax form shows the total FICA wages paid the total FICA taxes and federal income taxes withheld.

Most employers are tax-rated employers and pay UI taxes. State unemployment tax is a percentage of an employees. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

SUTA or the The State Unemployment Tax Act SUTA is a payroll tax paid by all employers at the state level. Current federal law provides employers with a 54 percent FUTA tax credit and no FUTA tax credit reduction will occur in 2022 for wages paid to their workers in 2021. Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage base.

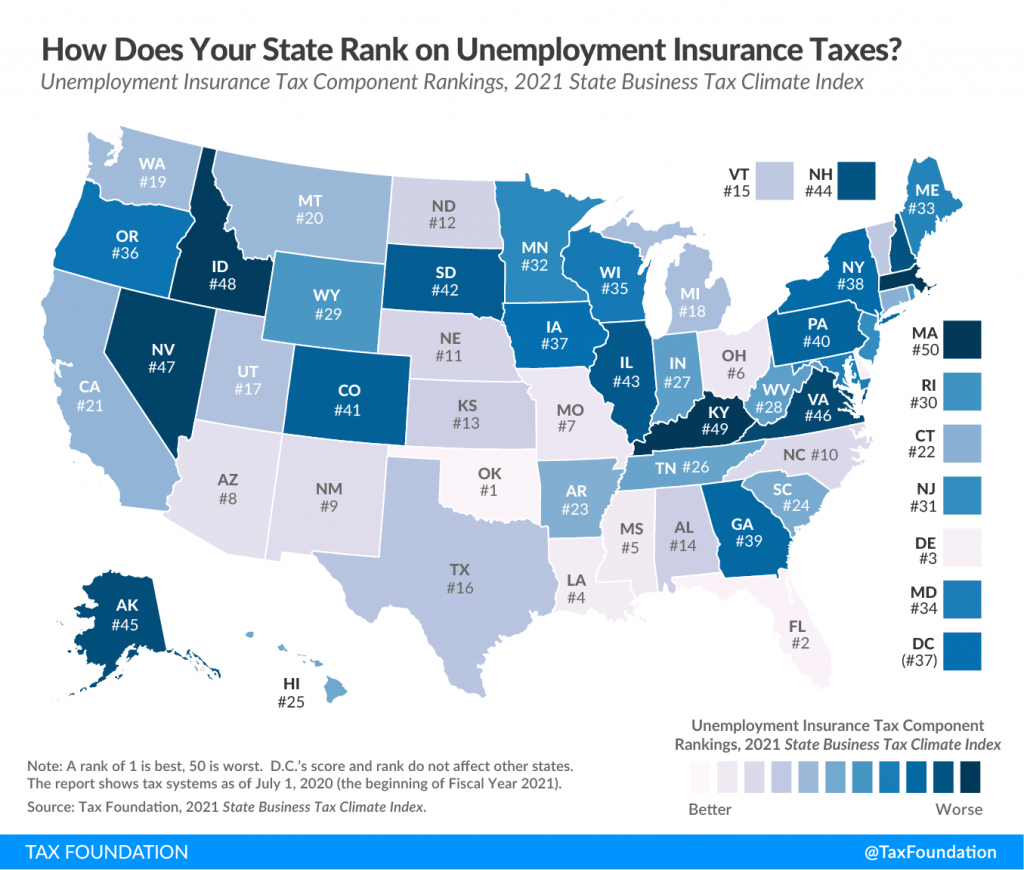

The state UI tax rate for new employers known in some states and federally as the standard beginning tax rate also can change from one year to the next. You cannot protest an SDI rate. California Employers Guide 䐀䔀 㐀㐀尩 倀䐀䘀Ⰰ 㐀.

California uses the Dynamex ABC Test to determine whether a worker is an employee for purposes of unemployment tax coverage. What is suta tax rate for california. California does have an outstanding loan balance as of January 1 2021 so future.

The taxable wage limit is 145600 for each employee per calendar year. All UI taxes for 2022 have been paid in full by January 31 2023. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

What is SUTA. You have employees with the following annual earnings. This new law effective January 1 2005 provides for employers who are caught illegally lowering their UI rates to pay at the highest rate provided by law plus an additional 2 percent.

Federal Unemployment Tax Act FUTA FICA. States use funds from SUTA tax to pay unemployment benefits to unemployed workers. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

Since your business has no history of laying off employees your SUTA tax rate is 3. 52 rows SUTA the State Unemployment Tax Act is the state unemployment. Californias unemployment tax rates and wage base are not to change in 2022 while the state disability insurance wage base is to rise the state Employment Development Department said Oct.

For past tax rates and taxable wage limits refer to Tax Rates Wage Limits and Value of Meals and Lodging DE 3395 PDF or visit Historical Information. Most states send employers a new SUTA tax rate each year. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state.

This discounted FUTA rate can be used if. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. New employers pay 34 percent 034 for a period of two to three years.

Employers remit withholding tax on an employees behalf. The SDI withholding rate for 2022 is 110 percent. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays.

However some states Alaska New Jersey and Pennsylvania require that you withhold additional money from employee wages for state unemployment taxes SUTA tax. SUTA was established to provide unemployment benefits. Imagine you own a California business thats been operating for 25 years.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. The states SUTA wage base is 7000 per employee. California law defines wages for state unemployment insurance SUI purposes as all compensation paid for an employees personal services whether paid by check or cash or the.

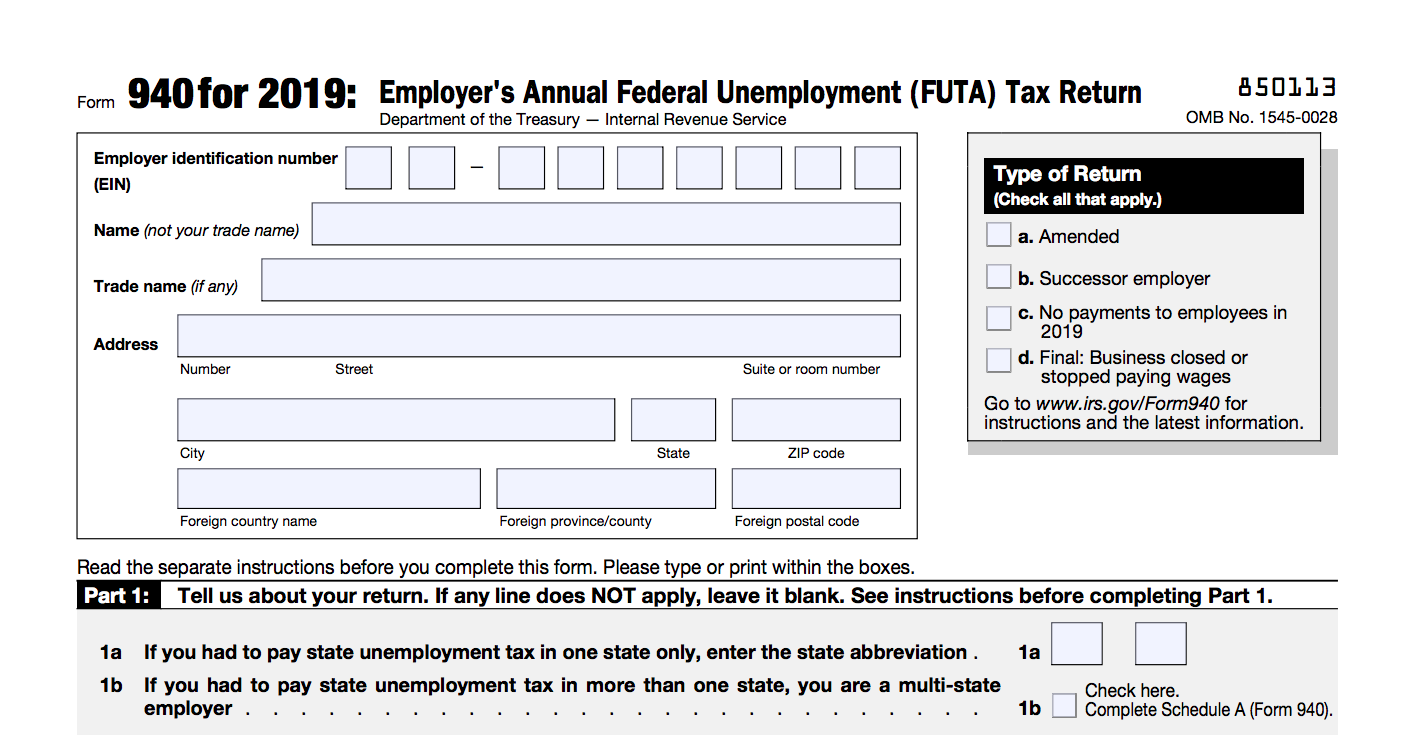

Federal Unemployment Tax Return Form 940 Wage and Tax Statement Form W-2 and. For the majority of states SUTA tax is an employer-only tax. AB 664 - With the passage of AB 664 California became one of the first states in the nation to enact legislation as a result of the federal SUTA Dumping Prevention Act.

Nanny Payroll Part 3 Unemployment Taxes

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

Sui Sit Employment Taxes Explained Emptech Com

What Is Futa Tax 2021 Tax Rates And Information

Self Employed Unemployment Insurance Can Business Owners File

South Dakota Employers Can Take Advantage Of Online Payroll With Patriot Pay Payroll Software Payroll South Dakota

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

The True Cost Of Hiring An Employee In California Hiring True Cost California

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

Suta State Unemployment Taxable Wage Bases Aps Payroll

2022 Federal Payroll Tax Rates Abacus Payroll

Ezpaycheck Payroll Software Futa And Suta

Suta Tax Your Questions Answered Bench Accounting

What Is Sui State Unemployment Insurance Tax Ask Gusto

Futa Tax Overview How It Works How To Calculate